Secured loans have a back guarantee, so interest rates are low. Mortgage rates are low due to the current interest rate market and the upcoming vacation season.

You may need an emergency loan at any time. It is time to finish asset management. Your property acts as an emergency safety net. In India, housing assets are an important element of wealth management.

Elderly people insist on getting a home whenever such a situation occurs. Banks offer homeowners a variety of lending options. They are available with repayment terms tailored to nominal interest rates and immediate liquidity needs.

That said, one option to consider is a mortgage when you're looking for a loan in addition to a mortgage. Borrowing a mortgage is a common way for people to raise money for home purchases and home remodeling.

What is a home equity loan?

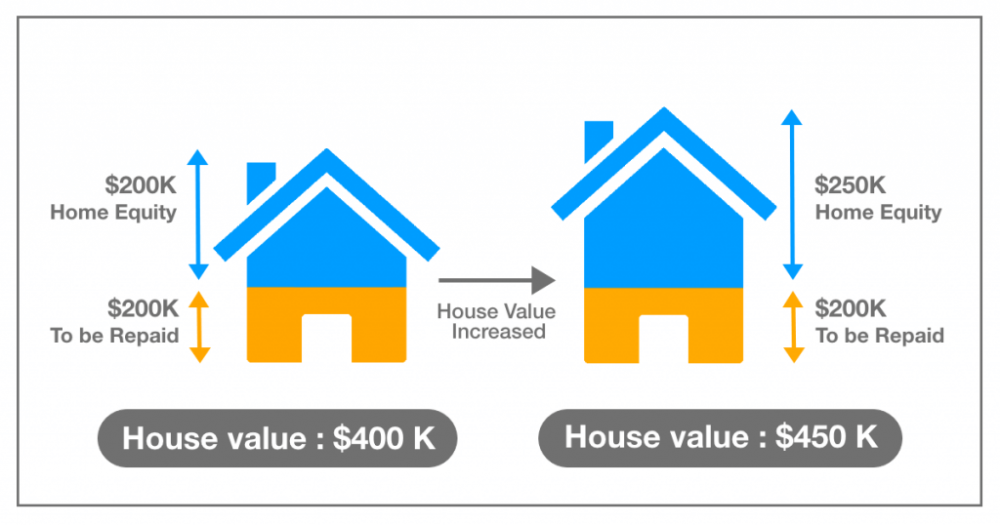

It is also known as a second mortgage, a mortgage loan, or just a second mortgage. Based on the market value of the real estate, your lender will give you a loan.

That said, even if you have a continuous mortgage on your property, you can still get a mortgage. When this happens, the borrower uses the current market value of the property as the basis for determining the loan value for which the loan balance should be deducted. About 50-60% of home prices should be covered by the loan.

Taking a mortgage can be an advantage, but it can also be a debt trap as it reduces the stock value of your property over time. Without payment, your lender has the right to seize your property, which means you may lose your current home.

What are the benefits of a Home loan?

-Better interest rates for your budget: You may be able to negotiate a better interest rate for your budget. Unsecured loans have higher interest rates because there is no collateral to back them up.

-Secured loans have a back guarantee, so interest rates are low. Mortgage rates are low due to the current interest rate market and the upcoming vacation season. -Personal loans and credit cards may not offer as much cash as mortgages, but they are still useful.

-If the loan is used to buy a new property or renovate an existing property, you can deduct interest when filing your tax return.

Home loan-related risks

-There are risks associated with home equity loans, such as possible default payments. If this happens, the borrower can shoot your home. Lenders can also list properties in auctions if they have unpaid loans.

-A mortgage loan can be used as a second mortgage by paying the closing costs and fees associated with the first mortgage. A prepayment penalty applies if you repay the loan early. -Financial institutions offer fixed and floating rates, but most often offer lenders a floating rate. Choosing a floating interest rate is beneficial in a market where interest rates fall, but it can also be high when interest rates rise. The same thing happens if you choose a fixed rate loan instead.